Hire Employees or Hire Independent Contractors?

As a cleaning company owner, do you hire or contract your workers? You can’t train and tell contractors what to do but employees are too expensive to have in that industry, how do you manage your decision?

This is a trick question and the answer depends on several factors.

What Type of Cleaning Do You Do?

House cleaning – general and deep cleaning for single family homes, apartments & condos

Miscellaneous cleaning – attics, garages, RV’s, lodges, neighborhood community centers, move in-move out, spring cleaning

Organization – decluttering & junk elimination, organizing closets, cupboards, drawers, rooms and collections

Maid Service – homes & hotels & assisted living centers

Commercial Cleaning – offices and showrooms

Specialized Commercial – restaurants, hospitals, pet stores, grocery stores.

Carpet Cleaning – shampoo & extraction carpets, upholstery & drapes

Window Cleaning – indoor/outdoor multi-floor units, glass

Flood and Fire Restoration – deep cleaning, furniture moving, commercial equipment and chemicals

Post Construction Clean Up – After the construction crews leave before the first time buyers move in

Move In / Move Out Cleaning – between people moving in or out of a home

Listing Cleans – People list their homes with realtors to put them on the market – this usually involves staging and initial cleans, and emergency cleans before open houses and home showings.

The reason I ask this question is because all forms of cleaning are not created equal. Neither are the people expected to perform the jobs. The training required to teach your people how you like the job to be done will also vary based on the type of cleaning service you provide.

How Is Your Cleaning Company Set Up?

Are you a one person cleaning technician wanting to expand? If so, how big do you want to grow? And how fast?

If you only have one or two extra jobs, you could hire a contractor part time, but if you’re looking to bust into a new market and become the “go to” cleaning company, how many people are you prepared to hire?

Do you plan on providing any training?

Are you working out of your house or do you have an office/storefront?

Do you expect your employees or contractors to report directly to the job or will they be dropping by your home or office to pick up supplies?

Will you be providing company vehicles? Are you paying for the gas, service, repairs, inspection, registration, parking tickets?

Will you be providing auto insurance to your employees?

Cleaning Supplies & Equipment

Will you be providing cleaning supplies and vacuums? And will you provide vacuum repair and service?

Do you have a storage area equipped to house your supplies?

Do you have an ordering system in place for your cleaning supplies and equipment?

Are you renting or do you own your equipment? How often do you trade it out? Do you have service contracts on your equipment? (i.e. in case a commercial floor cleaner is in the shop for repair – will they lend you a replacement?)

What is the legal structure of your cleaning business?

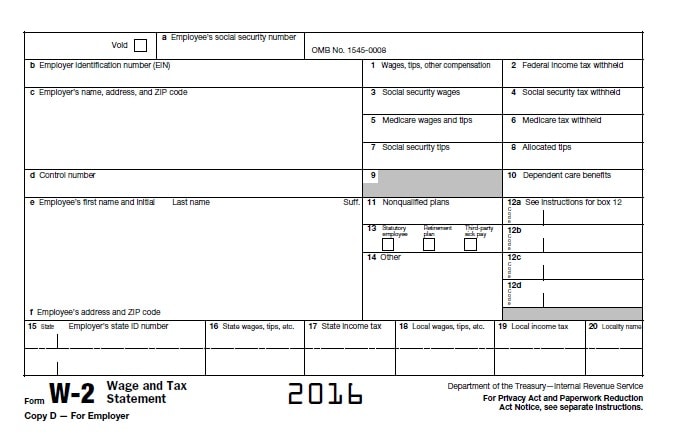

When you start a cleaning company you’ve got to decide the structure for your business. Are you going to set it up as a Sole Proprietor? A Partnership, a Corporation, S Corporation or a Limited Liability Company (LLC)? How you structure your business determines how you will file your taxes and which forms to use. Here’s the breakdown from the IRS to help make your decision a bit easier.

The federal government levies four basic types of business tax:

- Income tax

- Self-employment tax

- Tax for employers

- Excise taxes

To learn more about these taxes, visit the Internal Revenue Service’s (IRS) Guide to Business Taxes.

Federal Income Taxes

Select the form of your business below to find out which federal tax forms you need to file:

State Income Taxes

Nearly every state levies a business or corporate income tax. Like federal taxes, your state tax requirement depends on the legal structure of your business. For example, if your business is an LLC, the LLC is taxed separately from the owners of the business, while sole proprietors report their personal and business income taxes using the same form used to report their business taxes. Consult the General Tax Information link on the State and Local Tax Guide for specific requirements.

The structure of your business is super important because your taxes will be different if you hire employees rather than hire an independent contractor.

How do you want to operate your cleaning business?

How many people do you want to hire? And when? Do you need six new people right now – or will you hire as you grow? It is possible that you hire a part-time contractor now and then set up a plan where you will hire regular full and part-time employees for the near future.

Do you have enough work to keep employees busy full time?

How many employees or contractors you have to work on a single unit? Will you have a single technician on each job or will you have a team or three or four?

Will you provide their bonding and insurance and Workers compensation?

If you are hiring an independent contractor, will you require them to be bonded and insured? Will you have them sign a release waiver so you don’t get sued if they get hurt on the job?

How will you find, recruit and screen your cleaning employees or contractors?

Do you have a recruiting plan in place for either employees or independent contractors?

Will you run ads, and do the interviews yourself or will you outsource your job recruiting to another company?

Do you have a screening program in place? You don’t want to be in the house cleaning business and accidentally hire a registered sex offender who may have access to family photos and know the layout of people’s homes. Nor do you want to hire a convicted felon who served time for larceny. Your company reputation is on the line. If you hire an independent contractor, you are working off your own reputation and theirs. And if you have employees, everybody is working off your reputation.

Payroll – W2 or 1099?

How do you plan to pay the help you hire?

Do you have a fixed pay rate?

Can you guarantee your hired help a certain number of working hours to an employee or independent contractor?

Do you have a payroll company in place?

Here’s help finding the right solution for your cleaning business

Your question is a good one, but it is one of many. You may want to sit down with a paid consultant to help you work through these ideas. Running a business is not easy – but it is one of the most rewarding things you can do during your business career.

Go easy on yourself – you’re not going to have answers overnight for all these questions. You will have to do some digging around to find the perfect solution for your situation. I encourage you to get started if expanding your business is the goal.

If you are wanting to get more information on the cheap – here are three places I recommend:

1. The Small Business Administration

SCORE provides no or low-cost business training and education online and in your community. Every week, SCORE hosts a LIVE webinar on a variety of business topics. They also have mentors who will give you free business advice. Find a Score Mentor.

2. Join Facebook Cleaning Groups

There are numerous cleaning groups on Facebook. I recommend you find one specific to your cleaning type.

We also have a private Facebook group that offers house cleaner training and maid service training. For a limited time we are offering free membership – and then it will be part of a bundled package that provides support for our training. Please join us at Facebook Group for House Cleaners

3. Join a Linkedin Cleaning Group

The Worldwide Cleaning Association has a group on Linkedin that has 25,792 members. Many of the members are in the commercial end of the cleaning business. There are daily blogs posted and lots of peer-to-peer support. Membership in the Linkedin Group is free and as a member, I highly recommend joining and participating in the conversation.

Though that group – you will find mentors specific to your industry and type of cleaning. Many are coaches, offer training, have authored cleaning related books or have podcasts. Challenge yourself to get involved…and tell them I sent you. 🙂

FREE STUFF

How to Start Your Own House Cleaning Company

More articles like this

Guide to Business Taxes

State and Local Tax Guide

Sole Proprietorship

Partnership

Corporation

S Corporation

Limited Liability Company (LLC)

SCORE by The Small Business Administration

Find a Score Mentor

Facebook Group for House Cleaners

ISSA Commercial Cleaning Linkedin Group